Ho Chi Minh City Is Surprisingly In The Top 3 Most Preferred Destinations For Cross-Border Investment

At the end of 2022, Ho Chi Minh City on being in the top 9 cities that are preferred by international real estate investors. Only a few months later, Ho Chi Minh City has climbed to the 3rd place only after Tokyo and Singapore. More encouragingly, Hanoi also ranked at 9th place.

Top 10 preferred cities for cross-border investment

Source: CBRE

According to CBRE’s early year report, Singapore is now the second preferred destination for cross-border real estate investors in Asia-Pacific, up from third place last year. Tokyo retains its top spot for four consecutive years. Meanwhile, Ho Chi Minh City surprisingly came in the third position for the first time, up 6 places compared to the late of 2022.

It comes as a sequence of investors applying opportunistic strategies, grasping the progress of traffic projects in recent times, and catch the bottom area while waiting for the market to rise.

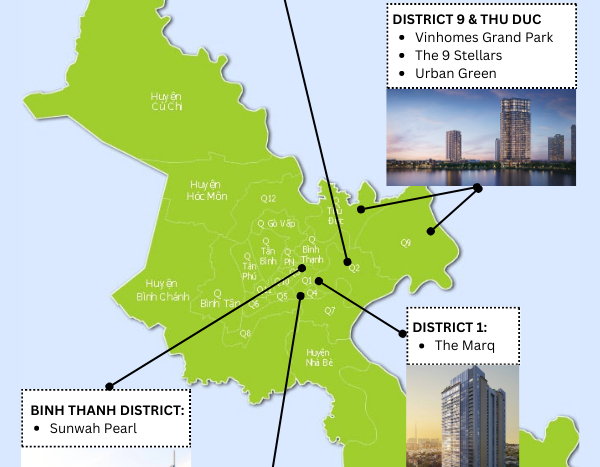

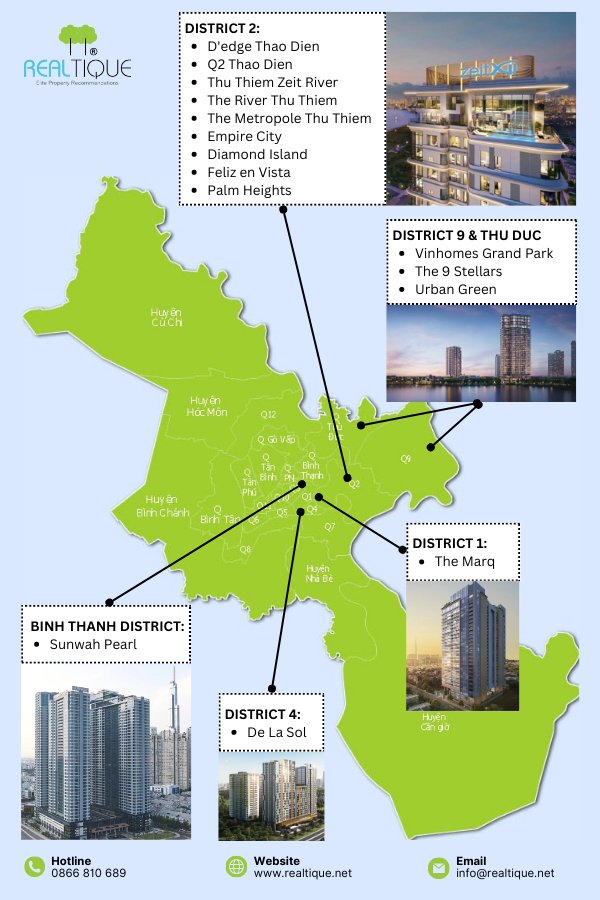

The CBD area including District 1, District 4 and Thu Duc City are three of the areas that catch the eyes of investors when planning to invest in Ho Chi Minh City. Especially, Thu Duc City which is located in the east of the city is currently being promoted to become a nuclear residential area soon with a densely deployed new transportation system. When completed, this will be a place with incredible growth potential.

A few significant projects that is in Realtique’s top list

[[sc-btn||text= Resell & Rental Properties In HCMC||type=url||value=https://realtique.net/blog/en/hot-resell-rental-properties-in-hcmc?inf_contact_key=ce098eae48ad60de622b605c4391c57ef651f238aa2edbb9c8b7cff03e0b16a0]]

Hanoi also joined the top 10 rankings this year, coming in at number nine. According to CBRE, developers, investors, and end users are all looking for chances in the Vietnamese market.

Hong Kong has risen to the top five for the first time since 2020 thanks to investors attracted by China’s reform and more affordable prices.

According to the consultant, opportunistic methods will pick more steam this year as investors look for distressed prospects and hope to profit from market fluctuations. Also, these investors eager to spot possible synergies between the public and private markets.

Greg Hyland, head of capital markets for CBRE’s Asia-Pacific region, anticipates an increase in investment activity in the second half of the year.

The majority of investors are taking a cautious stance despite good levels of fundraising as they wait for indications of yield expansion and a stabilization of the interest rate tightening cycle, he observed.

Investors once more favored the industrial and logistics sector, which continues to benefit from structural developments like e-commerce expansion and strong market fundamentals. The following favorite sectors were office and residential.

Only 5% of investors intend to make investments in alternative industries. ESG (environmental, social, and governance) considerations will be used in investing decisions by about 60% of investors. Due to rising expenses and the current state of the economy, the remaining 40% intend to postpone implementing ESG.

Realtique Co., LTD

+84866810689 (WhatsApp/Viber/Zalo/WeChat)