Is Ho Chi Minh City Residential Market Slumping?

While the world economy is on the brink of recession, Vietnam still maintains a stable growth momentum.

But there are still many doubts…

Vietnam’s economy is about to crisis? Unstable residential market? Real estate prices slump?

Let’s find out the most objective answer.

GDP Continues To Grow

Words will not be enough to convince you that Vietnam’s economy is still on the rise.

So let’s look at the numbers…

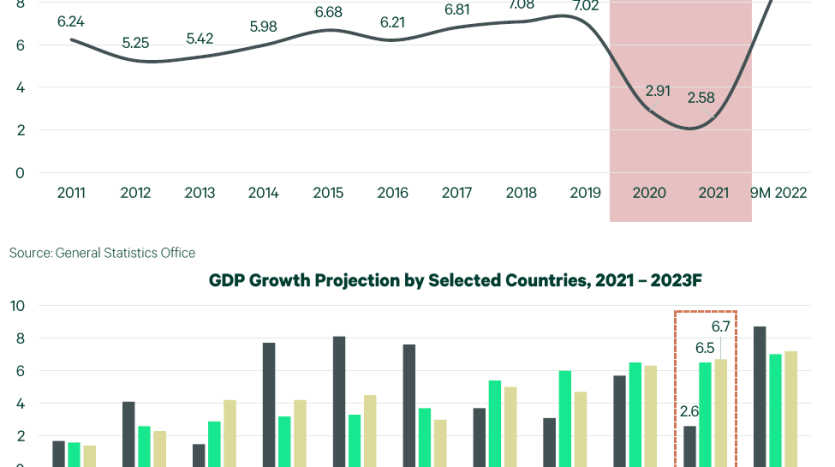

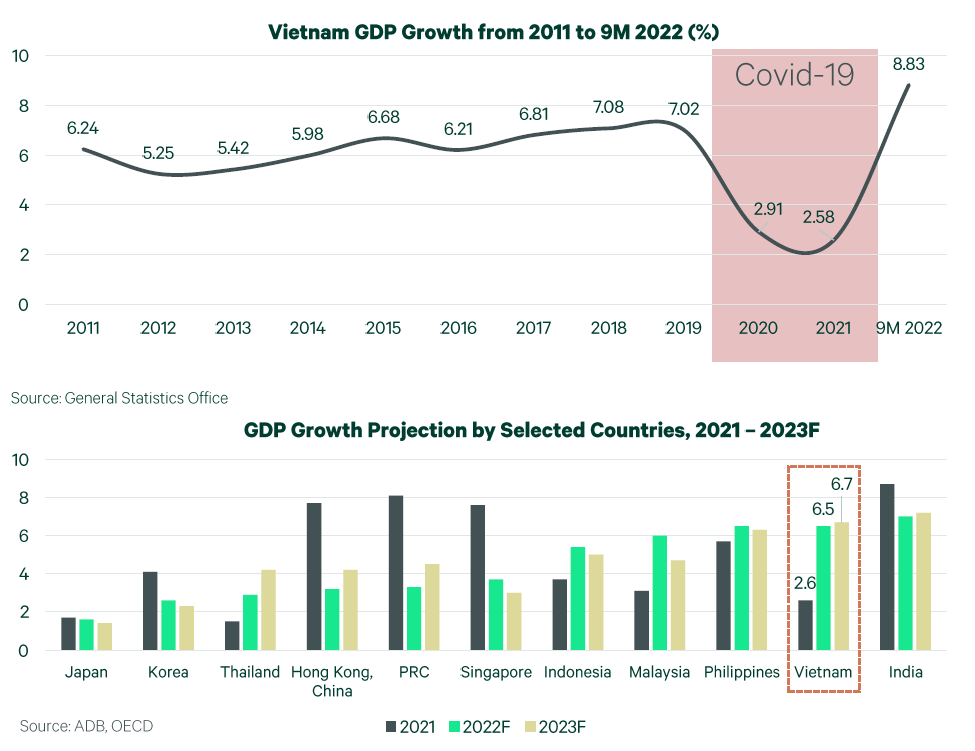

Even in Covid-19 pandemic, the growth of Vietnam’s GDP is still at a high level

Remember the article about the APEC 2022? The IMF Managing Director commented that Vietnam is a regional economic spotlight. According to forecasts, the GDP growth of the whole year will continue to increase to 6.7% in 2023.

It can be seen that Vietnam is one of two countries with stable GDP growth in the period 2021-2023. Soon opening borders after the Covid-19 pandemic, Vietnam’s GDP experienced a “leap” of 2.5 times compared to 2021.

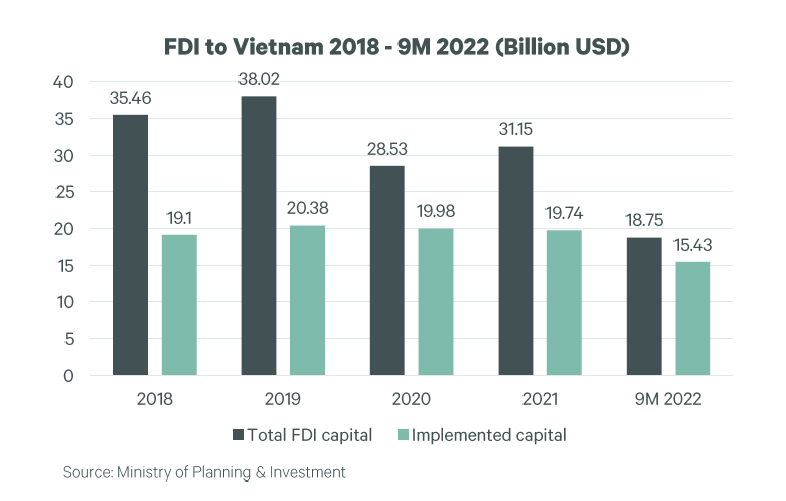

Vietnam Is An Attractive Investment Destination

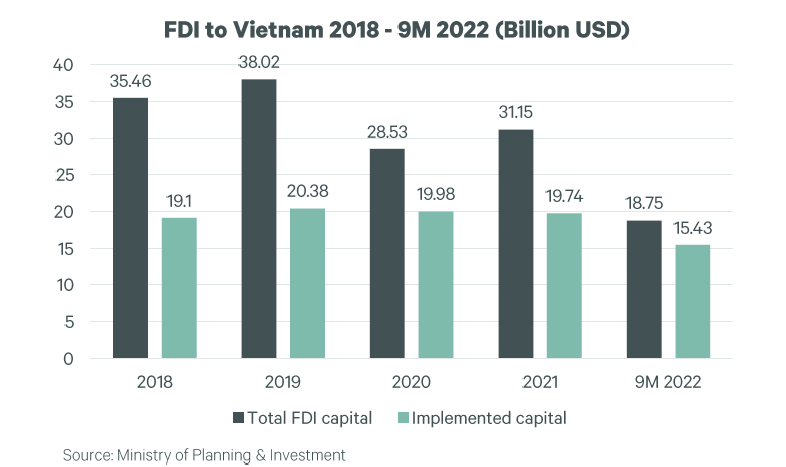

Let’s continue to look at the total FDI capital invested in the Vietnam market in 2022, nearly $19 billion!

And the implemented capital accounts for over 82%.

In just 9 months after re-opening, Vietnam has become the destination for many projects, specifically:

In just 9 months after re-opening, Vietnam has become the destination for many projects, specifically:

- September 2022: Lotte E&C (Korea) kicked off Lotte Eco Smart City Thu Thiem with total investment capital of $900 million

- July 2022: CapitaLand Development (Singapore) announced investment in an 8ha land plot for a residential complex in Thu Duc City

- February 2022: CapitaLand Development signed a Memorandum of Understanding on Investment Cooperation with Bac Giang province to develop the first industrial – logistics – urban park in Vietnam with a total estimated capital of $1 billion

- Lego Group (Denmark) announced the $1 billion Lego factory in Vietnam and ground broke in early November 2022

- Gaw Capital Partners (Hong Kong) completed the plan to acquire Saigon Hi-tech Park.

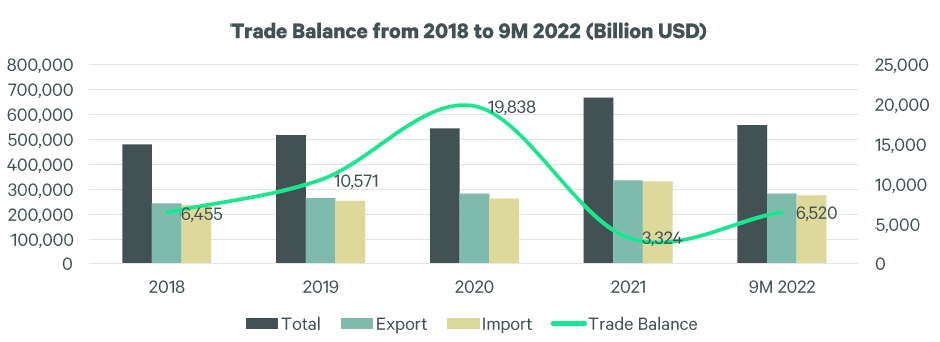

Trade Surplus Of Nearly 7 Billion Dollars

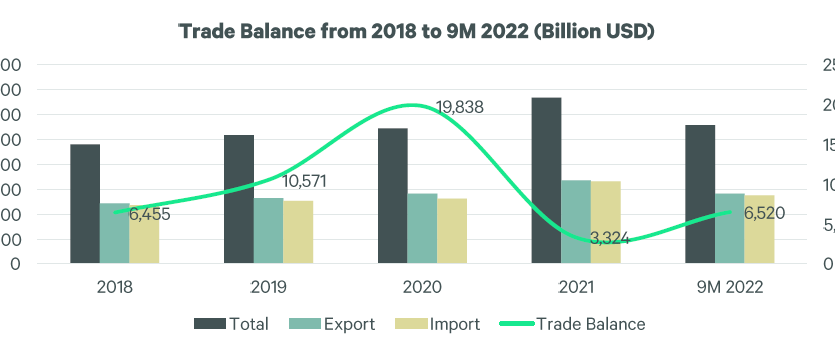

Exports recovered quickly after the epidemic, the trade balance had a trade surplus of $6.52 billion. Export and import turnover is expected to reach 282.5 billion USD, as of the fourth quarter of 2022, up 17.3% over the same period last year.

The United States and China are the largest export and import markets, respectively.

Besides, Vietnam has tightened international diplomacy after APEC 2022 and ASEAN Summit to bring about beneficial commitments in terms of trade and export.

Besides, Vietnam has tightened international diplomacy after APEC 2022 and ASEAN Summit to bring about beneficial commitments in terms of trade and export.

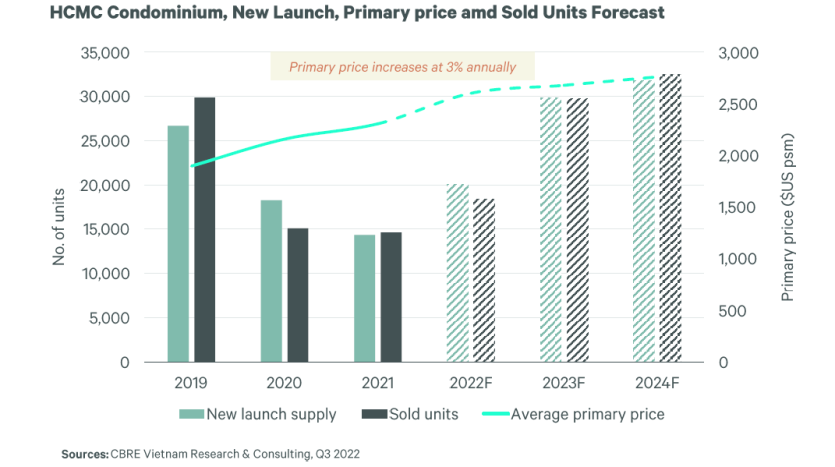

Condominium Price Is Forecasted To Rise

This prediction is not “in vain”. The above factors are the reasons for the residential market to have a stable price increase in the coming year.

Looking back the past few months…

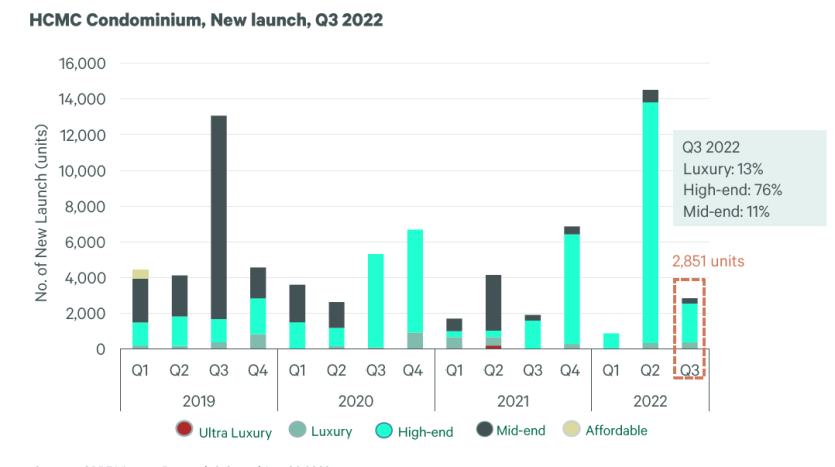

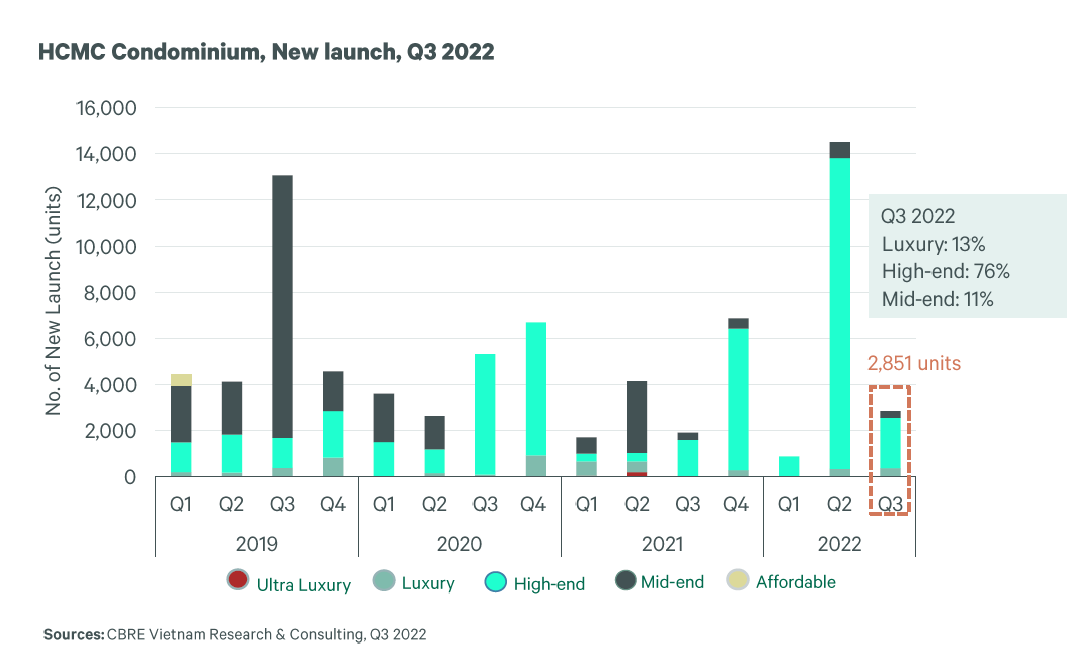

Condominium in Ho Chi Minh City lacks new supply, most of the current supply is coming from the latest phases of current projects in the East (Thu Duc City) and the South (District 7, Nha Be).

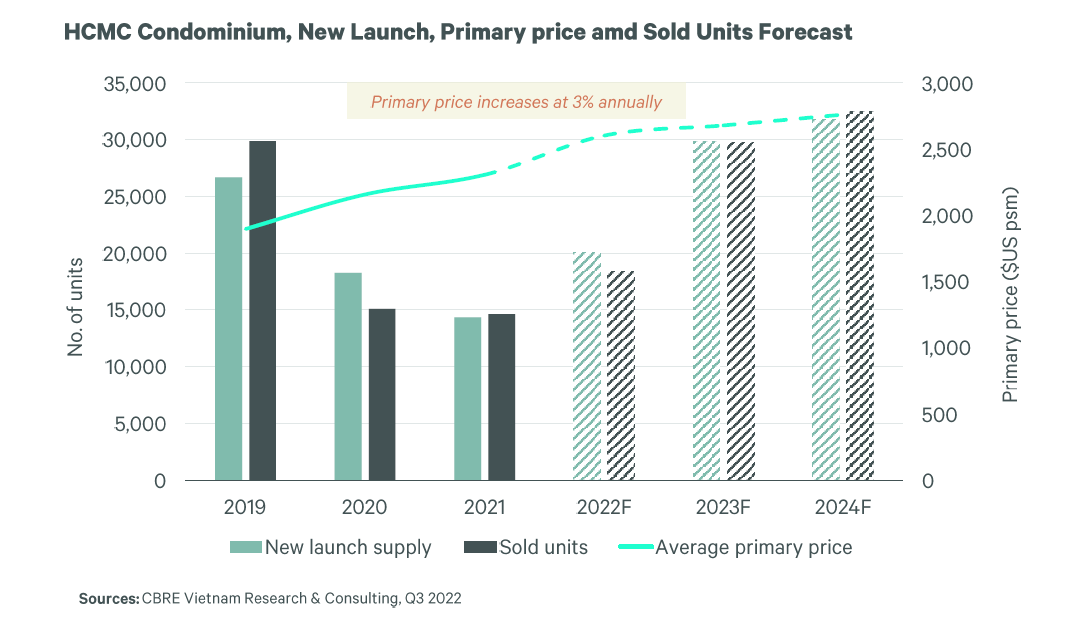

And of course, the primary selling price has yet to decrease. The average selling price in the market reached $2,545/sqm, an increase of 3.4% compared to the previous quarter. The uptrend in price is recorded in the mid-end segment such as Urban Green (Thu Duc City), The Alpha Residences (Thu Duc City)…

The pressure from increasing price of new projects, the scare supply of mid-end apartments and the increasing demand has impacted the surge of secondary price.

It is predicted that after 2022, the primary market will recover as before the epidemic when the legal and credit issues are resolved. Average primary selling price is forecasted to continue to increase slightly of about 3%/year.

These predictions also apply to landed property market such as The Classia, The Global City…

These predictions also apply to landed property market such as The Classia, The Global City…

Having no new projects, very high starting price of new supply, the secondary selling price is forecasted to increase in the future.

In fact, the real estate is experiencing a short-term issue. The reason is that the secondary supply is too much, along with credit and legal restrictions, making it difficult for the market to absorb even though the demand is still there, leading to low liquidity. However, this is the time when developers offer attractive policies and diverse properties to attract buyers.

There Is Always A Chance

You and I have already had the answers…

…that in the period of 2022-2023:

- Vietnam’s GDP will grow well to over 6.5%

- Many FDI projects will be started

- Trade balance will continue to grow thanks to open foreign policy

- The residential market has not “cooled down” but has also recovered and grown

If you are a wise investor, having a strong financial ability and a 3-5 year vision, this time is considered to be suitable for real estate investment.

In the period 2024-2026, after Ho Chi Minh City real estate has recovered and is on the rise, profitability is within reach of investors who know how to seize opportunities right now.

Please contact Realtique for latest update of special projects and events on the market.

Realtique Co., LTD

+84866810689 (WhatsApp/Viber/Zalo/WeChat)