Global Gasoline Price Stabilization Scenarios & Price Storm Map

The first half of 2022 witnessed continuous fluctuations in gasoline prices around the world. Reasons from the Russia-Ukraine war, the US and Europe imposed sanctions on Russia, China blockades major cities to fight epidemic and the need for post-Covid-19 recovery in many parts of the world.

So, how is the overall picture of gasoline price fluctuations around the world going on?

And, what scenarios for gasoline prices to stabilize in the near future?

Join Realtique to find out when the current gasoline price fluctuations end through the following analysis:

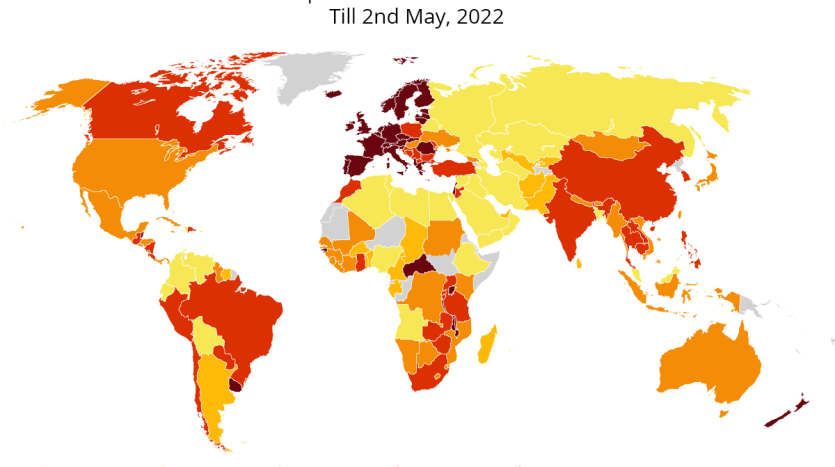

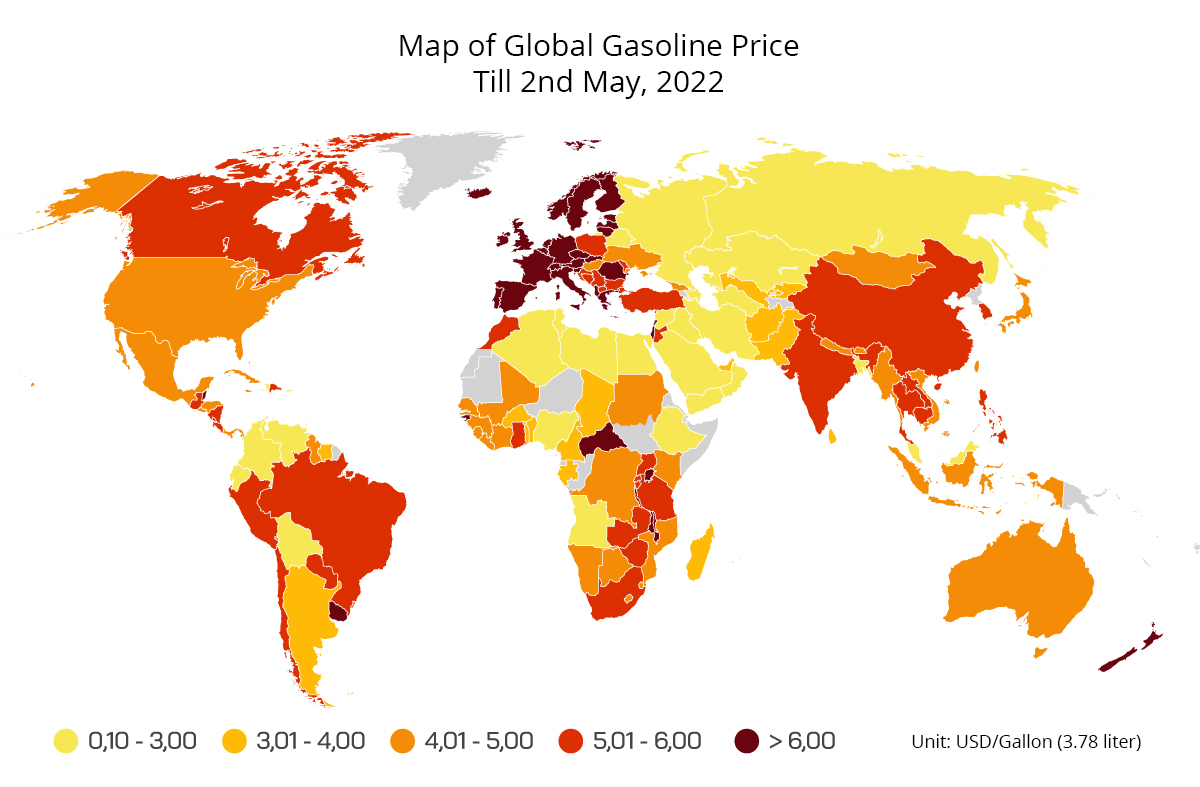

Global Gasoline Price Storm Map

The demand for travel is gradually increasing in the post-Covid-19 period. However, the gasoline supply cannot keep up with it; together with the US and European sanctions on Russia is causing a lot of turmoil in the global oil supply chain.

Currently, the consequences of the turmoil in the global oil supply chain are evident in at least the following groups of countries in the world:

Global Gasoline Price Storm Map. Graphics: Tien Thanh VnExpress

Countries With The Most Expensive Gasoline Price from 6 USD/Liter

European countries, mostly Western Europe, are carrying the highest gasoline prices. This is because sanctions imposed on Russia have blocked major oil supplies.

In addition, European and North American countries have shifted to clean energy for many years. Therefore, it is difficult to increase oil production to alleviate the current supply crisis.

Countries With Expensive Gasoline Price Due to Inability to Produce 1.6 USD/Liter

Including East Asian countries such as India, China, Korea, Thailand…

Hong Kong is at the highest gasoline price in the world with 11USD/Liter.

Countries With Gasoline Price Cheaper Than Bottled Water 0.3 USD/Liter

Countries that produce a lot of oil and are in surplus such as Venezuela, Libya, Iran and other countries in North Africa, the Middle East, Central Asia and Russia.

The United States is currently the world’s leading oil producer. But American oil companies are not interested in increasing oil production, despite the sharp increase in oil prices and US President Joe Biden pushing production, since businesses and investors are not sure that oil prices will maintain high long enough to profit from drilling more new wells.

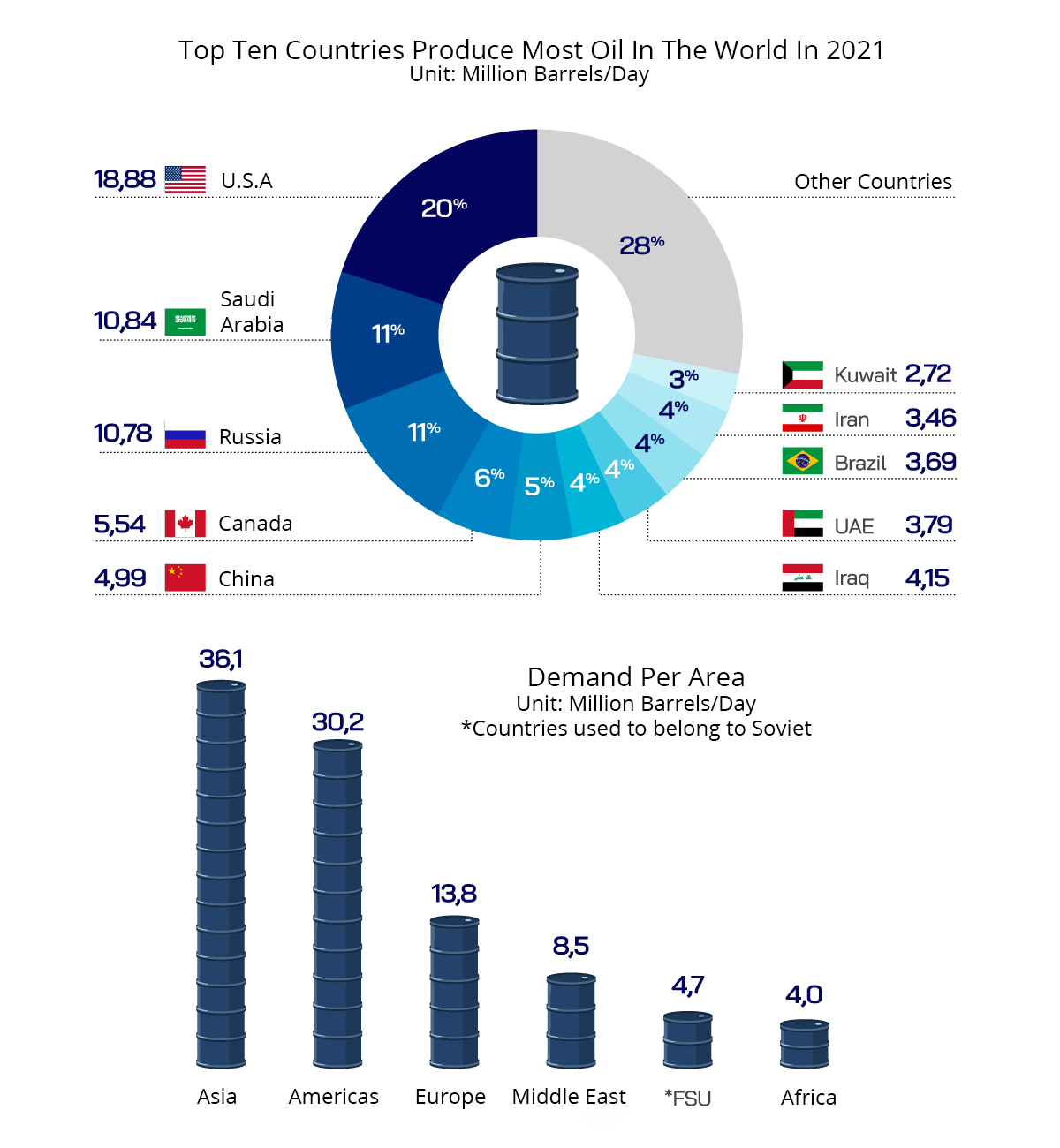

Top 10 Oil Production Countries in the World 2021. Graphics: Tien Thanh VnExpress

Thus, the upcoming oil price volatility will not be likely to change much, as the supply continues to fluctuate from the Russian oil import ban policies of European countries and the US, increasing oil production supply is hardly feasible when clean energy is prioritized and investment profits for additional oil production are left open.

What Is The Upcoming Oil Price Volatility Scenarios?

Self-Adjustment

The gradual increase in supply towards the end of the year and slowing demand growth (due to high oil prices, weak economic prospects) will cause the world market to self-adjust to a rebalancing state.

This month’s latest IEA report estimates supply will rise to 99.8 million barrels and global oil demand at 99.4 million barrels a day from now to the end of the year.

The top areas for oil production are still the America and the OPEC+ group. Leading demand is still Asia and America.

Oil Flow Change

Analysts said that the Russian punishment by the West has not created much volatility with the global oil supply. It only causes the oil flow to change direction.

Accordingly, instead of shipping oil to European countries, Russia will boost shipments to other markets such as China, India and Turkey. In return, those countries will buy less oil from the Middle East, leading to an increase in oil from this region to Europe.

Countries Promulgating The Gasoline Price Subsidy Policy

Some countries choose to stabilize the market with price subsidies, such as Iran, Saudi Arabia, Malaysia… For example, the price of gasoline in Malaysia is currently about 0.4 USD per liter, thanks to the government subsidy.

Some other countries such as the US choose to release stockpiles.

South Korea, South Africa, Thailand, Canada, Vietnam, Netherlands… and many other countries choose to reduce taxes to lower gasoline prices.

In general, between now and the end of 2022, the impact from the escalation of gasoline is likely to slow the world economic recovery following the Covid-19 epidemic, but the rebalance will soon be established as majority. All countries in the world have plans to cool down gasoline prices, supply increases gradually and demand is adjusted towards more economical.

Realtique Co., LTD

info@realtique.net

+84866810689 (Whatsapp/Viber/Zalo/Wechat)