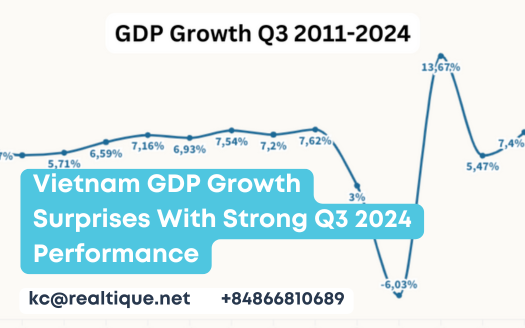

Vietnam GDP Growth Surprises With Strong Q3 2024 Performance

The recent announcement of a 7.4% GDP growth for Q3 2024, surpassing earlier forecasts, highlights a notable economic momentum that warrants examination. Notably, the manufacturing sector’s strong growth of 11% signals a potential turning point in industrial activity, while the agricultural sector grapples with the repercussions of Typhoon Yagi. As we consider the implications of these figures, it becomes essential to investigate the underlying factors contributing to this performance and the challenges that loom ahead, particularly in terms of sustainability and future growth trajectories. What might this mean for the economy moving forward?

Vietnam 2024 GDP Growth Highlights

Reflecting strong economic resilience despite recent challenges, Q3 2024 GDP growth reached an impressive 7.4%, significantly surpassing the forecast of 6.7%.

This sturdy performance is complemented by an overall GDP growth of 6.82% for the first nine months of the year.

An outstanding contribution to this growth stemmed from the industrial and construction sectors, accounting for 48.1% of the GDP.

Notably, manufacturing experienced its highest growth in six years, achieving an 11% increase.

This resurgence, particularly in industrial activities, emphasizes the economy’s ability to recover swiftly from disruptions.

The positive indicators of growth highlight a strengthening economic environment, setting a promising tone for future performance and stability in the face of unforeseen challenges.

Typhoon Yagi's Economic Impact

In the wake of Typhoon Yagi, the economic terrain faced substantial challenges, with estimated damages reaching 81,500 billion VND across 26 provinces in the northern region.

The typhoon impacted approximately 41% of the GDP and affected 40% of the population, particularly hitting the agricultural sector hard, resulting in significant production losses.

However, the overall economic damage was about 30 times less severe than the natural disasters of the previous year, indicating some resilience.

Notably, industrial activities showed a swift recovery, with production quickly resuming in several areas.

This resilience suggests an ability to bounce back from adversities, potentially setting the stage for future growth despite the immediate challenges posed by Typhoon Yagi.

Regional economies demonstrated extraordinary resilience and growth in the aftermath of Typhoon Yagi, with several provinces bouncing back effectively despite facing significant challenges.

Notably, Hai Phong and Quang Ninh recorded impressive GRDP increases of 9.77% and 8.4%, respectively, highlighting their strong recovery efforts. Other regions, including Lao Cai and Yen Bai, also maintained strong growth rates, showcasing the overall strength of local economies.

Businesses quickly adapted to post-disaster conditions, resuming industrial activities and supporting economic revival. While the typhoon’s impacts were felt primarily in specific sectors, particularly agriculture, the swift recovery of industrial production underlines the region’s capacity to rebound.

This growth path positions these economies favorably for future development and stability.

Export Performance Insights

Export performance in the third quarter exhibited a complex environment, with total exports reaching 299 billion USD in the first nine months, marking a 15.4% year-on-year increase. Key sectors contributing to this growth included textiles and machinery, reflecting resilience amidst global uncertainties. However, challenges remain, particularly regarding cost pressures and competitiveness.

| Sector | Exports (Billion USD) | Year-on-Year Growth (%) |

|---|---|---|

| Textiles | 27 | 8.9 |

| Machinery | 40 | 12.5 |

| Electronics | 35 | 10.1 |

| Agriculture | 20 | 5.0 |

As major companies secure substantial orders for Q4 2024, proactive strategies are essential to steer through the ongoing market challenges effectively.

Industry Challenges Ahead

The current environment of industry challenges presents significant obstacles that companies must maneuver to maintain growth momentum. Despite a strong Q3 2024 performance, businesses face rising costs and decreased competitiveness, particularly in export sectors.

The recent decline in export volumes from July to August raises concerns, as companies strive to secure new clients while managing operational expenses. In addition, the textile industry, though showing growth, must steer through pricing pressures that threaten profit margins.

Companies are increasingly prioritizing efficiency improvements and cost reductions to sustain their market positions. Additionally, the lingering effects of Typhoon Yagi on agricultural production complicate the recovery process.

Strong indicators of future economic growth signal a promising path for Q4 2024, with projections suggesting GDP growth could surpass 7%. The resilience demonstrated by various sectors, particularly industrial and construction, is expected to continue driving economic momentum.

Consumer spending, although currently lagging behind GDP growth at 5.8%, is anticipated to pick up as confidence returns. The government is urged to implement measures that stabilize the economy and control inflation, thereby promoting an improved business environment.

Additionally, agricultural adaptations post-typhoon could stimulate growth as farmers shift to quicker-growing crops. Overall, the outlook remains optimistic, with expectations of a stable annual growth rate around 6.8%, contingent on effective policy measures and continued recovery efforts across affected sectors.

Strategic Recommendations for Recovery

To sustain the positive path indicated by future growth projections, strategic recommendations for recovery must be prioritized across various sectors.

First, enhancing the business environment through regulatory reforms will attract foreign investment and stimulate local entrepreneurship.

Second, targeted support for the agriculture sector is essential, particularly for farmers adapting to post-typhoon conditions, by providing access to innovative farming techniques and financial assistance.

Third, investment in infrastructure to facilitate industrial growth should be accelerated, focusing on regions most affected by Typhoon Yagi.

Finally, addressing the rising costs faced by manufacturers through tax incentives and subsidies will improve competitiveness in export markets.

These strategies collectively promote resilience and long-term economic stability, essential for navigating future challenges.